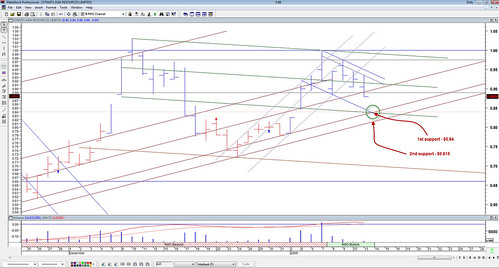

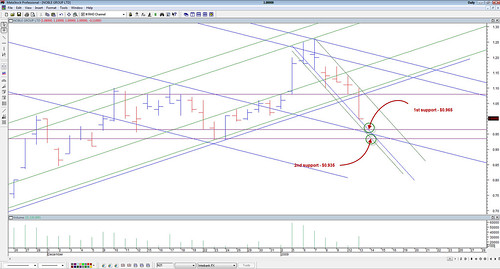

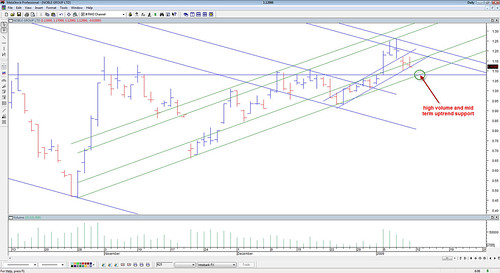

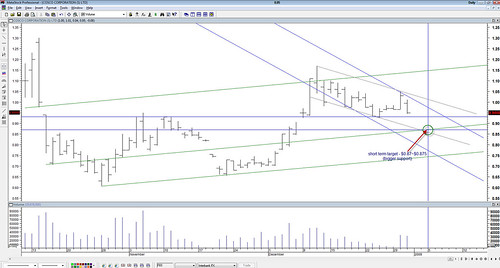

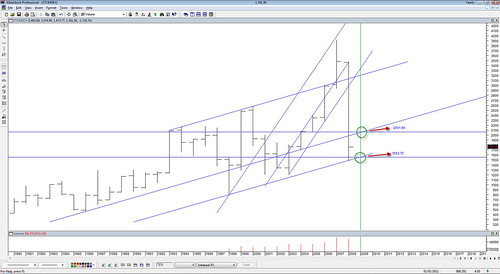

Noble hit support of $0.965 and could have turned up.

Need one more confirmation - red channel.

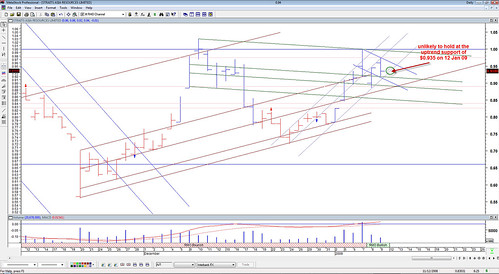

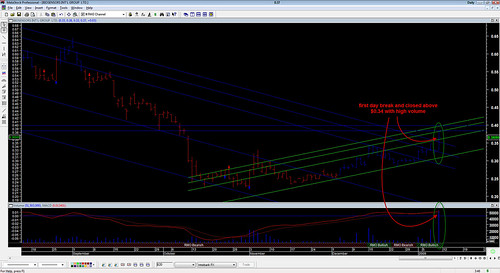

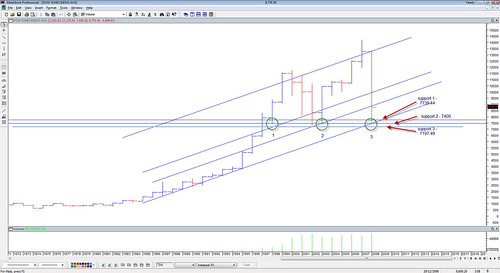

Mon (19 Jan 09) trading range is $1.01-$1.05. ($1.01 is the big volume on 16 Jan 09. Looks creditable)

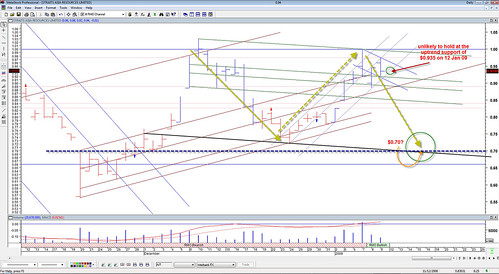

If it can closed above $1.05, I think we can see for a short term uptrend.

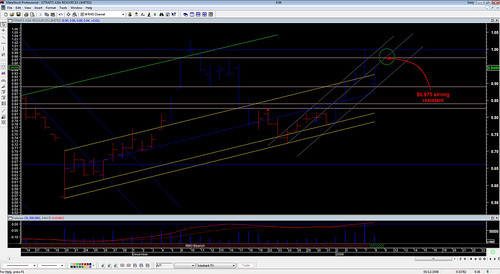

My target is $1.14.

Given the volatility of Noble, it may hit $1.17 again.

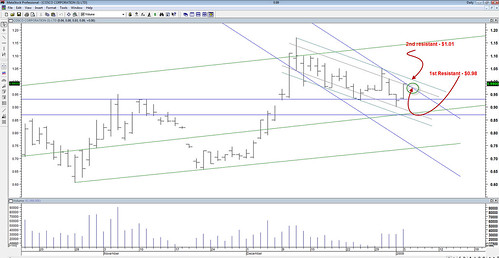

Got to cross $1.09 before this.